29+ how to pay mortgage biweekly

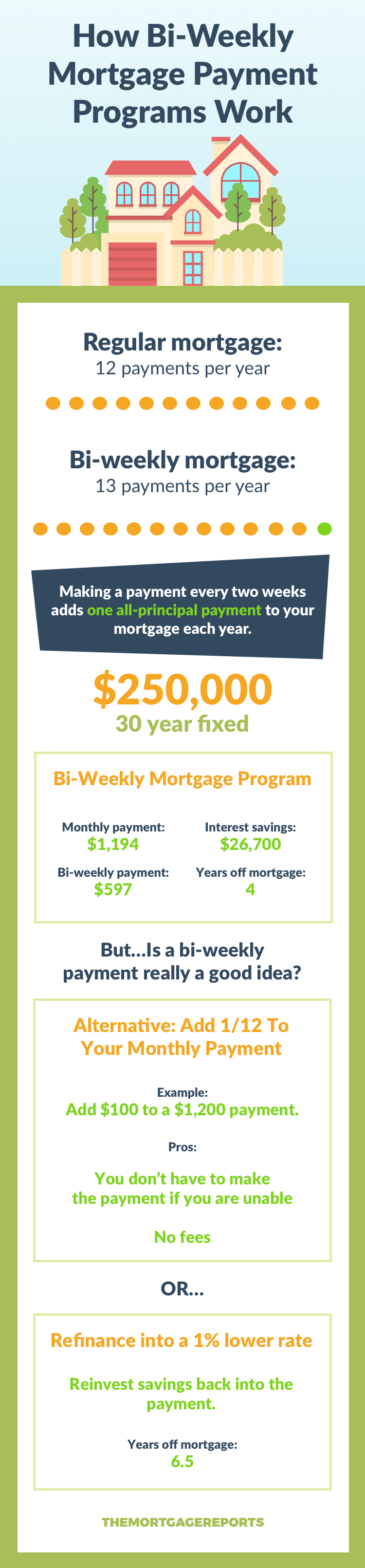

Instead of making a single monthly mortgage payment each month or 12 payments per year you make a. Web If your lender cant or wont allow you to set up normal biweekly payments without fees just open a separate bank account dedicated to making your mortgage payment.

Any Benefit Of Weekly Home Mortgage Payments Wsj

Explore Top Rated Information.

. Web Option 1. Ad Pay Off Your Mortgage Sooner - Calculate How Much You Could Save. If you have a 300000 mortgage at 4 for 30 years biweekly payments will save you.

Your savings will be the same as if your lender allows you to schedule biweekly payments. If you elect the Biweekly Advantage loan you will be set up on an automatic draft for your payment. Web With biweekly mortgage payments you split your monthly payment in half and pay it every two weeks.

By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12. Web Pay less interest. You can deposit your half-payment amount there every two weeks and use that money to make your full monthly mortgage payment could be automatic or by check.

Make your payments biweekly. Make an extra principal-only payment of that amount every month. 1000 Total paid annually.

Web Biweekly mortgage payments There is an alternative to monthly payments making half your monthly payment every two weeks. Web Take your monthly mortgage payment and divide it by 12. If you want to pay less interest on your mortgage shave years off your term and dont mind paying bills every two weeks biweekly.

Web This is the principle behind biweekly mortgage payments a form of mortgage acceleration. 2 Look at a calendar. Web By rounding that payment up to 2500 102 more you could pay off your loan almost three years earlier and save nearly 52000 in interest.

That means biweekly payments will end up saving you 64392 in interest payments. Web How we make money. Web Say your loan is 200000 on a 30-year fixed-rate mortgage with a 4125 interest rate.

Biweekly payments mean you pay off your loan 4 years and 3 months early by making the equivalent of one extra payment per year. This simple technique can shave years off your mortgage and save you thousands of dollars in interest. Web Your monthly payment amount is about 1703 and youll pay 313212 in interest charges over the life of the loan.

Web Calculate the difference between biweekly and monthly payments. Web 4 hours agoThe APR was 702 last week. Web Depending on qualifications we also offer a 30-year loan and Biweekly Advantage mortgage.

You can split your monthly payment in half logging into your account every two weeks to make a payment. Web If youre facing fees for getting on a biweekly payments schedule you can do it yourself without involving the lender or a third party at all. We are compensated in exchange for placement of sponsored products and services or by.

Paying your mortgage as quickly as possible can save you tens if not hundreds of thousands of dollars. The higher your interest rate and the more youve borrowed the more you could save. If your mortgage is 100000 and you have a 30-year fixed-rate mortgage with the current rate of 696 you will pay about 663 per month in principal and interest.

In comparison your biweekly mortgage payment is about 851 and youll end up paying 248820 in interest over the life of the loan. There are twelve months in a year so if you pay your mortgage once a month you make 12 payments over the course of a year. One extra payment made each year.

This payment schedule can help you save money on interest and build equity in your. Step 1 Divide your monthly payment by 12. Or save that amount every month for 12 months in a separate savings.

Well take a look at it from both a monthly and biweekly payment perspective. You can redeem them for. Web Biweekly payment payment made every 2 weeks.

445 66 votes Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks. When you make biweekly payments you could save more money on interest and pay your mortgage down faster than you would by making payments once a month. Web 23 hours agoThe card earns 5 Rocket points per dollar for all purchases.

Web A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two weeks for a total of 26 payments each year. This option requires you to stay on top of these manual payments. Step 2 Put that much money in a savings account each month and continue making your monthly payments normally.

Your retail Rocket mortgage loan closing costs including down payment at a rate of 1 cent each. At that rate by the end of the. Web Simply by performing the steps of switching to biweekly payments and directing an additional 50 monthly to your mortgage you can reduce its length from 30 years to 23 years and eight months.

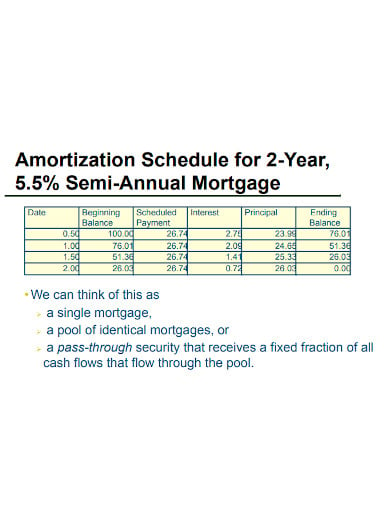

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. The 25-year and 30-year mortgage loans are paid back through monthly payments while the Biweekly Advantage Loan has payments every two weeks. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Bi Weekly Mortgage Program Are They Even Worth It

How To Pay Your Mortgage Biweekly 9 Steps With Pictures

Mortgage Calculator With Bi Weekly Payments

Biweekly Mortgage Calculator How Much Will You Save

Why You Should Consider Making Biweekly Mortgage Payments Vs Monthly Hassle Free Savings

Will A Weekly Bimonthly Or Biweekly Payment Mortgage Really Save Me Money

How To Pay Biweekly Mortgage Payments Quora

:max_bytes(150000):strip_icc()/ForeclosureRatesintheU.S.-0d61541396e241e7bd6076afd117ddf5.jpg)

How To Make Biweekly Mortgage Payments

Biweekly Mortgage Payments An Easy Trick To Do Them For Free

:max_bytes(150000):strip_icc()/how_to_make_biweekly_mortgage_payments-c36591d68d8043e794cf1bf9c7d9c195.jpg)

How To Make Biweekly Mortgage Payments

How To Use Biweekly Payments To Pay Off Your Mortgage Faster Rocket Money

Bi Weekly Mortgage Payment Savings Biweekly Mortgage Amortization Program

Should You Make Bi Weekly Mortgage Payments Experian

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

11 Mortgage Amortization Schedule Templates In Pdf Doc

Bi Weekly Mortgage Payments And Its Benefits For Homeowners Youtube

Why You Should Consider Making Biweekly Mortgage Payments Vs Monthly Hassle Free Savings